Project BDI: the Socioeconomic Impact of

Comparable Property Analysis

through GIS 1

Cromwell MANALOTO, Daniele BRANCATO, Alessandro

DALMASSO, Luca DAL BUONO, Angelo CRESCENZI, Italy

Cromwell Manaloto

1)

The paper was presented at the FIG Commission 3 Workshop and Annual

Meeting in Iasi, Romania and was selected among the papers at the

workshop to be FIG Article of the Month. The article focuses on the BDI

– Real Estate Comparable Database Project, created to provide a

strategic tool to all entities operating in the real estate sector.

SUMMARY

The Banca del Dato Immobiliare (BDI – Real Estate Comparable

Database) is a project spearheaded by the College of Surveyors and

Graduate Surveyors of the Province of Ascoli Piceno developed in 2014.

The pilot project was created to provide a strategic tool to all

entities operating in the real estate sector, for example: as a market

analysis and asset management tool for enterprises; for Jurisdictional

authorities, the project would offer greater guaranty and transparency

on judicial sales and division while reducing eventual divergence

between the real estate value and price; for real estate valuers and

appraisers, it serves as an essential instrument in order to remain

compliant with the International Valuation Standards, Real Estate

Valuation Code by Tecnoborsa, the ABI Guidelines, the UNI 11558 and UNI

11612.

The BDI project was developed with the valuable and active

cooperation of the Order of Notaries Public of the Province of Ascoli

Piceno, with its members communicating a summary datasheet from every

deed of sale executed starting from the 1st of February 2014.

The elaborated data, which are potentially new “comparable property,”

are then inserted in the digital database. The BDI can therefore provide

precised geo-referenced and filtered data, optimized by “feature” or

characteristic of interest in order to favor faster and informed

decision making procedure thus, saving time and money.

This paper aims to illustrate the project, from the data acquisition

technique used, the archiving process and the planned GIS database using

the comparables previously gathered and stored. Moreover, this paper

will also look into the project’s socio-economic impact on one of its

macroterritory: Ascoli Capoluogo.

SUMMARY (Italian)

La Banca del Dato Immobiliare (BDI) è un progetto promosso dal

Collegio dei Geometri e Geometri Laureati della Provincia di Ascoli

Piceno.

Il progetto, primo in Italia, nasce con lo scopo di fornire uno

strumento strategico a tutti i soggetti che operano nell’ambito del

settore immobiliare, ad esempio: imprese della filiera immobiliare, per

le analisi di mercato e lo sviluppo di progetti Asset Management;

Organi Giurisdizionali, per ridurre drasticamente le divergenze tra

valori e prezzi offrendo maggiori garanzie e trasparenza nelle vendite

giudiziarie e nelle divisioni; professionisti Valutatori Immobiliari che

devono operare nel rispetto degli Standard Internazionali di Valutazione

e del Codice delle Valutazioni Immobiliari di Tecnoborsa, delle Linee

Guida ABI, della Norma UNI 11558 e della Norma UNI 11612.

Il progetto della BDI si sviluppa con la preziosa e fattiva

collaborazione dell’Ordine dei Notai della Provincia di Ascoli Piceno il

quale, attraverso i suoi iscritti, comunica i dati sintetici derivanti

dalla stipula di ogni compravendita a partire dal 1° febbraio 2014.

I dati, opportunamente “lavorati”, vengono poi inseriti in banca

dati. La BDI fornisce quindi ai soggetti che ne fanno richiesta la

possibilità di ottenere dati georeferenziati e filtrati, ottimizzati

allo scopo per le caratteristiche d’interesse al fine di operare le

proprie scelte con maggiore cognizione e rapidità e risparmio di tempo e

danaro.

Questa ricerca illustrerà il progetto stesso, dall’acquisizione dei

dati, l’inserimento dei dati raccolti ed il successivo progetto di

plottaggio su una mappa digitale in piattaforma GIS. La medesima ricerca

osserverà anche l’impatto socio-economico del progetto, soprattutto in

una delle proprie macroaree, ovvero della circoscrizione Capoluogo.

INTRODUCTION

The Banca del Dato Immobiliare differs from that of the government

digital cadastral database in terms of the ability of the technicians

that use the extracted data. The pragmatism of Italian surveyors, their

nature to be concretely technical and their ability to also exploit the

few and minimal information to get the best result, set up the necessary

flexibility to manage such a project in continuous evolution along with

other successive information.

The data properties that are needed for the purpose of estimating,

appraisals, and market analysis are few. Starting with a few readily

available data, a joint collaboration with the Provincial Order of

Notaries Public, and a few surveyors who have devoted much of their

time, it was possible to create a strategic tool fundamental for all

those who work within the real estate sector.

It is now a stable propensity of Italians to save, with deflationary

consequences resulting from the sharp drop in consumption.

Despite the recent strong global crisis, the current social-economic

situation is generated by the lack of availability to risk or at least,

to notice that there is more willingness to address them outside the

national borders. There is a clear lack of interest in investing in

Italy.

The reasons are many but certainly solvable but with the right

commitment from political resources and the availability of social

forces.

It is now established that investors, whether they are Italian or

foreign, need transparency, continuity, and socio-political trust.

Alternatively, an investment is carried out only with the inevitable

speculations.

The BDI project falls in our continuous commitment to transparency and

reliability.

THE PROJECT – The Beginning

In November 2014, the Tribune of Ascoli Piceno noted the importance

of utilizing a standardized estimation methodology. Other Provincial and

Regional Courthouses soon then followed such initiative, requiring of

the introduction of the said methodology in an expert’s report.

However, the Provincial College of Surveyors of Ascoli Piceno

decided, at least, to primarily limit the content of the database only

to the concept of "price" and therefore excluding temporarily the

concept of "value." In doing so, it was possible to temporarily and

greatly reduced the number of data (about a thousand). At the same time,

it was necessary to also focus on the reliability of the datum. With

that in mind, the valuable collaboration with the Order of Notaries

Public, who shared the project and who have also understood the

functional potentiality as a strategic market analysis tool.

Obviously, to get a sufficient amount of data needed to be able to

carry out UNI-compliant valuations, or to do market analysis, it would

have taken at least six months or so of data collection. The

College of Surveyors of Ascoli knew of the extraneous amount of sourcing

to proceed with the project but was sure that the efforts would be worth

it.

Only when real estate appraisals will be conducted in the Standards,

and are in compliance with UNI, the inclusion in the database of the

"value" could be undertaken. This is to ensure more points of comparison

and to fully understand the divergence between market values and market

prices.

THE PROJECT - Real Estate Transfers: Memorandum of Understanding

between Notaries Public and Surveyors

On the 11th of December 2014, in Rome, a Memorandum of Understanding was

signed between the President of the National Council of Notaries Public,

Maurizio D'Errico, and the President of the National Council of

Surveyors and Graduate Surveyors, Maurizio Savoncelli, to start a

collaboration between the two categories, aimed at making the

proceedings of land transactions in line with the highest safety

standard for town planning and building profile.

The agreement provides disclosure of real estate transfers integrated

with an optional technical report, drawn up by a surveyor. The said

document should demonstrate cadastral due diligence, and a construction

and urban analysis. On this day, the notary is able to ensure an

absolutely safe transfer in terms of marketability of real estate.

Thanks to this technical report - written in behalf of the seller, and

determines specific indications and requests from the notary - as much

security will be guaranteed even under the technical examination profile

on the building’s conformity.

In this way, every party involved in the negotiations will have the

certainty of the conformity of the building, at the same time, it lowers

the incidence of litigation and administrative procedures for

unconformity amnesty.

To enhance the skills, to stimulate the development of their activities,

and to promote initiatives inspired by the collaboration between the

technical professions, are the principles that inspired the birth of

this Memorandum of Understanding that the National Council of Surveyors

and Graduate Surveyors agrees to uphold. It also wishes to expand access

to other technical professions access to this database.

Imagine how any company that has an interest in developing any

investment from the smallest to the largest, can obviously be interested

to contain the risks involved, especially in cyclical times of market

dealings.

Investment analysis is based on a huge amount of data and numbers:

prices, values, costs, time, size, types, locations, demographic

prospects, urban perspectives, environmental and socio-economic issues.

Similarly, the Real Estate Appraisers, who are about 500,000 people

sparsed on the national territory, will have to deal with the

irreversible process of professionalization, adapting to the norms set

by International Standards. The Real Estate Appraisers also have

essential need of reliable data to compare and to capitalize in

compliance with UNI 11558, and UNI will soon be passed and will be in

line with Market Value Approach of the Project UNI U98000240. Today,

over 75% of credit institutions which already operating under the

restrictive rules of AQR (Asset Quality Review), require their

“consultants” to possess at least, the ISO17024 certification by

February 2016, and to follow the A.B.I. Guidelines for Business Lending

Valuations. The interest then may have very important implications for

Court procedures and Civil Cognition Process.

First, there is opportunity to provide the adequate transparency by

demonstrating a real estate’s Market Value as defined int art. 4 par. 1

letter. 76 of Regulation no. 575/2013 - Capital Requirement Regulation,

thus justifying the succeeding base bid price. This ensures the debtor a

more responsive valuation of the property with the possibility of

eliminating speculation. On the other hand, this gives the creditor a

quicker solution to the Procedure; Finally, it provides security based

on a weighted investment derived from certain necessary data.

For the Cognition Process, it is of paramount importance to ensure the

certainty of value for both parties in the event of court divisions,

revocation, and in any other situation which requires transparency and

demonstrable results.

THE PROJECT – Timeline, Project Design and Data Collection

|

The BDI project is developed with the active cooperation of the Order

of Notaries Public of the Province of Ascoli Piceno, which, through its

members and affiliates, report a synthetic report from every deed or

title transfer from the 1st February 2015. The data, suitably

"processed", are then inserted in the database using a pre-existing

database schema from a Stimatrix City, a known valuation software in

Italy. The BDI therefore provides persons who request the opportunity to

obtain geo-referenced and filtered data, optimized in order of

characteristic of interest, resulting to a more informed and faster

comparable searching and decision, so saving time and money.

The project, which became fully operational and usable from the 11th

December 2015, is integrated with complete sets of data usage and

instructions readily available from the Provincial College of Surveyors

of Ascoli Piceno’s webpage. Monthly developments are published regularly

that allows analysis of multiple segments in each municipal area.

|

BDI covers the entire province of Ascoli Piceno, which is

composed of 33 municipalities. Subsequently, all municipalities are

grouped and divided in six macro-areas, each controlled and monitored by

a Coordinator.

The Coordinator of the Macro-area, oversees the management and

collection of property data conferred by “technicians” verifying the

correctness and completeness prior to data entry process in the

database. The Coordinator monitors the area to detect any useful detail

to identify or study recent the market trend/s, on new construction

and/or renovation.

The macro-areas are:

ZONA CAPOLUOGO: Ascoli Piceno, Folignano, Maltignano;

ZONA MONTANA: Acquasanta Terme, Arquata del Tronto, Montegallo,

Montemonaco, Palmiano, Roccafluvione, Venarotta;

ZONA COLLINARE: Carassai, Castignano, Comunanza, Cossignano, Force,

Montalto delle Marche, Montedinove, Offida, Rotella;

ZONA VALLATA: Appignano del Tronto, Castel di Lama, Castorano, Colli del

Tronto, Monsampolo del Tronto, Spinetoli;

ZONA MARE SUD: Acquaviva Picena, Monteprandone, San Benedetto del

Tronto;

ZONA MARE NORD: Cupra Marittima, Grottammare, Massignano, Montefiori

dell’Aso, Ripatransone;

Immagine 2 Competenza territoriale di ogni macroarea del BDI

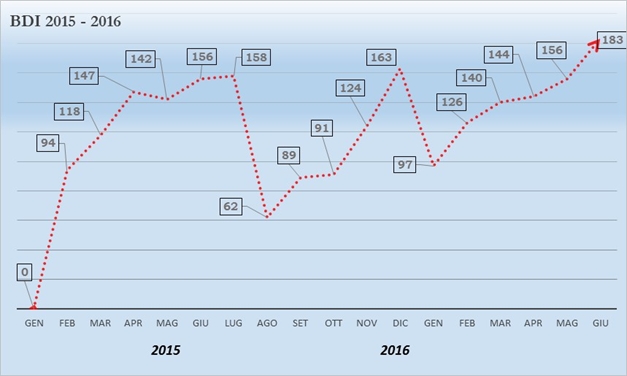

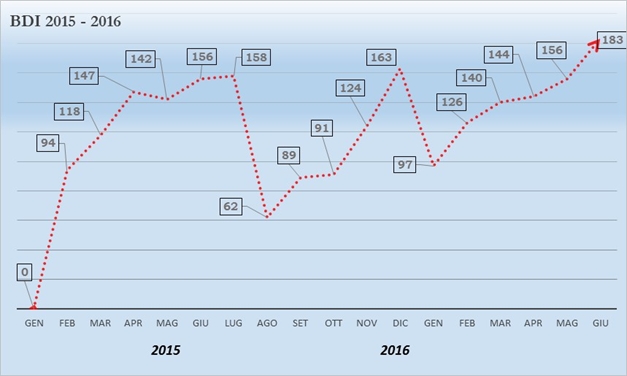

As of October 2016, over 2100 data or “comparables” are inserted in

the BDI database, with time range between February 2015 to June 2016.

Data gathered on 2016’s third quarter are still undergoing validation

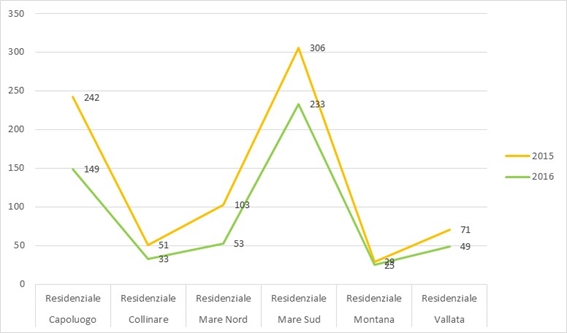

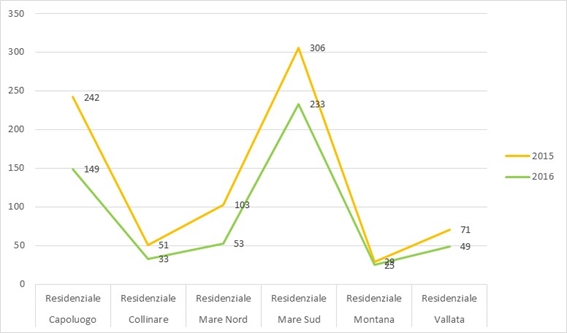

and rectification. Figure 1 shows the Data collection results in the

first one and a half year of the project.

Each validated deed or title transfer are transcribed to a “comparable

module” (on paper form or an excel sheet) handed by each coordinator.

The format was designed to give emphasis to the specific characteristics

that are essential for valuation purposes.

Each “characteristic” from the module, once inserted on the Stimatrix

City’s database, are transformed automatically into features of the

integrated GIS of the software. Furthermore, the cadastral data of each

real estate subject of the deed, allows the GIS operator to

geo-referenced or allocate the real estate precisely on the map. In rare

occasion, when the module was completed with errors, further research on

the exact building location is conducted.

Figura SEQ Figura \* ARABIC 1: Andamento temporale di inserimento dei

comparabili tratti da recenti compravendita archiviati nel BDI fra

febbraio 2015 e giugno 2016.

DATA ANALYSIS, RECOMMENDATIONS AND CONCLUSION

Out of the 2190 data archived in the BDI database, around 2072 are

extracted which are from the Province of Ascoli Piceno. The other data

reported and sourced were from the nearby provinces of Teramo, Fermo and

Macerata (Image 2). Among the various real estate destination,

residential buildings were the most contracted type with 1344 deeds

registered, followed by Building Accessory (Pertinenziale) and lastly,

Agricultural lands.

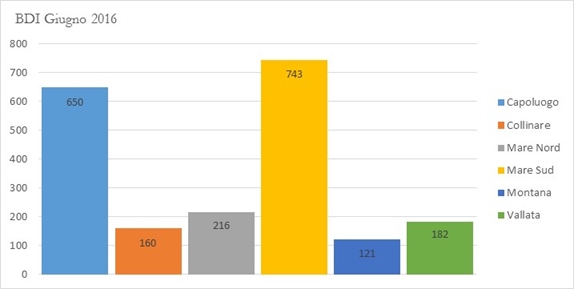

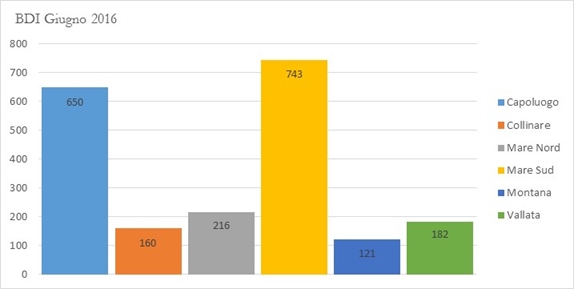

Figura SEQ Figura \* ARABIC 2 Situazione BDI al Giugno 2016 per

Destinazione Registrata dell’Immobile

The data shows that despite the fact that the Capoluogo hosts the

provincial capital, Ascoli Piceno, the Macroarea of Mare Sud seems to be

more active with real estate transactions, surpassing the Capoluogo by

37.8% in 17 months of the Project. This trend seems to be consistent

both in 2015 and 2016. The Municipality of San Benedetto del Tronto

seems to have a slightly more active real estate market despite having a

smaller area. Further analysis seems to indicate that the reason for

this trend is because of the geographical location of San Benedetto del

Tronto (seaside) and the abundant number of medium to high rise

condominium.

On the other hand, small Italian borghi have a limited amount of data

reported, thus, it could be hypothesized that they have limited

demographic movement.

Figura SEQ Figura \* ARABIC 3: Situazione BDI al Giugno 2016 per Comune

di Appartenenza

Figura SEQ Figura \* ARABIC 4: Distribuzione BDI per Macroarea

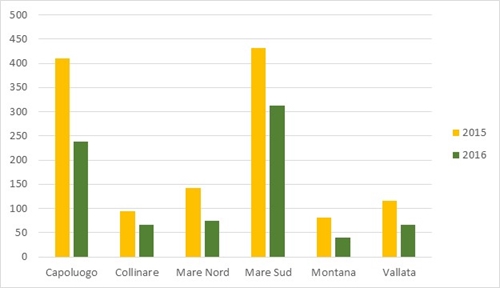

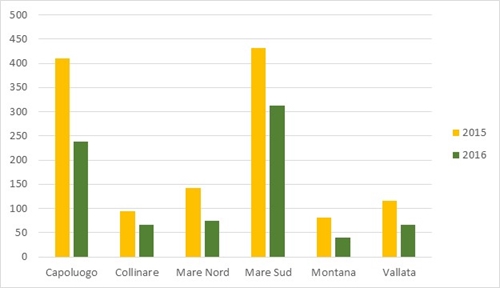

Figura SEQ Figura \* ARABIC 5 Andamento temporale dei BDI registrati

per Macroarea

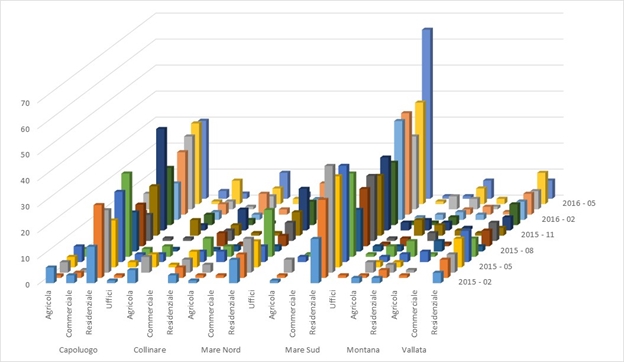

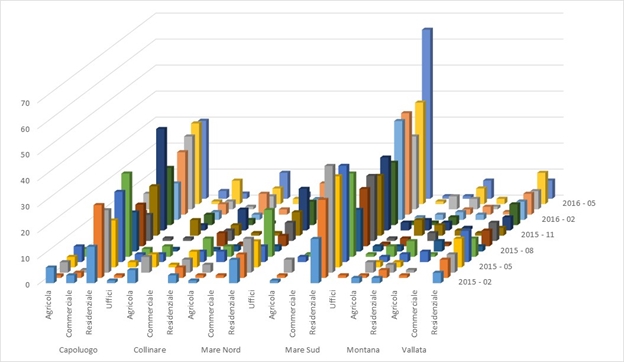

Figura SEQ Figura \* ARABIC 6 Dati BDI riferiti alla categoria

“Residenziale”

Figura SEQ Figura \* ARABIC 7 Tabella riepilogativa-comparativa dei

trend fra le Macroaree riferite agli immobili di destinazione Agricola,

Commerciale, Residenziale e Uffici

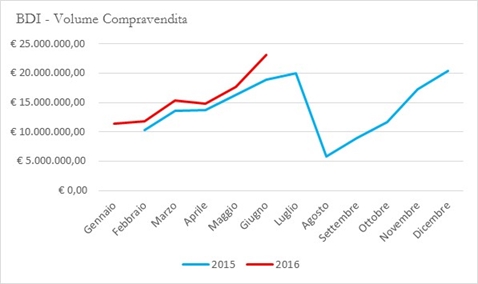

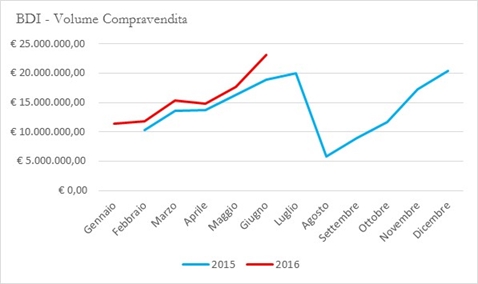

Figura SEQ Figura \* ARABIC 8 Grafico riepilogativo del Volume di

Compravendita distinto per anno

In figure 8, it is interesting to see that the total volume of title

transfers, in terms of price registered, for the first six months of

2016 have already surpassed the total volume per month of the previous

year. Despite having a negative market caused by the recent recession of

the last decade. It could be easily assumed that a sudden decrease in

the numbers of titles transferred will also happen in august 2016 when

most offices would be closed for the summer holidays.

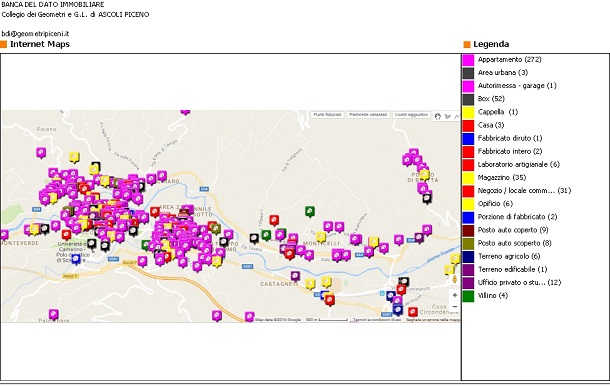

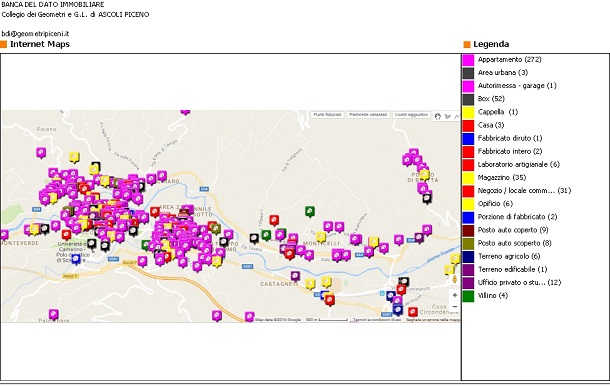

Figura SEQ Figura \* ARABIC 9 Estratto di mappa con collocazione

immobili inseriti

Interestingly, Ascoli Piceno's historic city center and the nearest

neighborhood of Porta Maggiore (figure 9) seem to be the preferred

location of most residential transactions despite having some

socio-political issues (i.e. lack of adequate car parking space,

elevated amount of carpark subscription, limited access to public and

private transportation, limited construction interventions, strict

compliance of cultural and historic construction preservation, higher

property tax quotient), in relation to newer neighborhoods and

residential expansions (Monticelli, Maltignano, Folignano).

One further improvement that the BDI project could have is to include

more detailed technical characteristics of the real estate, or some data

that could help identify the parties involved in the land transfer (age

group, previous residence area, private or company, etc). This kind of

demographic data could give a better understanding on different

urbanization phenomena and could easily help further research on urban

development of a certain market sector.

ACKNOWLEDGMENTS

A sincere thank you goes to the Provincial College of Surveyors of

Ascoli Piceno, in the person of Geom. Leo Crocetti, the College

President, and Geom. Angelo Crescenzi who spearheaded the BDI project,

both of which have been very helpful despite the setbacks and sacrifices

to be able to materialize an idea into a working and evolving project.

CONTACTS

Cromwell Manaloto

63079 Colli del Tronto (AP)

Via G. D’Annunzio 7

ITALY

Phone: 0039 349 1610645

e-mail: [email protected]

Angelo Cresecenzi

63100 Ascoli Piceno

Via della Repubblica 45

ITALY

Phone: 0039 0736 44589

e-mail: [email protected]

Daniele Brancato

Via Augusto Murri 12

97100 Ragusa (RG)

ITALY

Phone: 0039 329 0805477

e-mail:

[email protected]

Web Site:

www.danielebrancato.it

Alessandro Dalmasso

10060 Perrero (TO)

Via Monte Nero, 6

ITALY

Phone: 0039 0121 801801

fax: 0039 0121 801801

e-mail: [email protected]

Web site: www.dalmale.it

Luca Dal Buono

Via Sandri 3

40033 Casalecchio di Reno (BO)

ITALY

Phone: 0039 051 6218775 –

Fax 0039 051 6218776

Mobile 0039 347 8688458

e-mail:[email protected]

|